Across Canada, several provinces allow real estate agents to establish personal real estate corporations (PREC). As of the end of 2020, Ontario has become the most recent province that allows real estate professionals to incorporate. The ruling is in the Trust in Real Estate Services Act (TRESA), which took effect in October 2020.

When a real estate agent creates a PREC, they establish a separate legal entity or corporation. The corporation earns revenue, pays for any relevant business expenses and pays its own taxes. The real estate agent is the only registrant in the PREC and is responsible for all shares and responsibilities. Although the real estate professional owns and manages the corporation, the PREC is completely separate from the agent. It can own property and make investments separate from those of the agent.

Setting up a PREC offers several advantages to real estate agents but is not without its drawbacks. Learn more about the benefits and challenges of a PREC and how the incorporation of real estate agents in Ontario works.

Benefits and Challenges of a PREC

When set up properly, a PREC offers several benefits to Canadian real estate agents. To make sure establishing a PREC is the right choice for you, you might consider setting up an appointment with a tax expert who can help you weigh the pros and cons of incorporating and walk you through the challenges of the process.

Benefits of a PREC

The primary benefits of creating a PREC are financial. When set up correctly, a PREC can help real estate agents defer income for tax purposes, minimize capital gains taxes, partially deduct certain expenses, split income and choose how they want to get paid. Let’s take a closer look at the financial benefits of a PREC.

- Tax deferral: Corporate taxes in Ontario are lower than personal taxes. When you set up a PREC, the corporation will pay a tax rate of 26.5% on income above $500,000 and 12.2% on income under $500,000. In contrast, the maximum personal tax rate is 53.53% on income over $220,000. You can choose to have a certain amount of the PREC’s income paid to you as salary. To keep your tax rate down, you can choose to leave income in the PREC rather than pay it to yourself.

- Income splitting: A PREC also allows you to split income, paying certain family members a portion of the corporation’s income as dividends. Income splitting helps to reduce your tax burden. Since the process of income splitting can be complex, your best option is to work with a tax expert to figure out how much to pay family members and how to do it.

- Remuneration: With a PREC, you can decide how to pay yourself. The corporation might issue you a salary as well as bonuses or dividends. How you get paid by the PREC influences your personal income tax rate.

- Capital gains exemption: You might also benefit from a capital gains tax exemption on the disposition of qualified small business corporation shares if you sell some of the shares of your PREC.

- Expense deductions: If you have business expenses that are partially deductible, claiming them under the PREC rather than as an individual taxpayer can save you money.

Challenges of a PREC

The appeal of a PREC is that it allows you to take advantage of tax savings. Before you start a corporation, though, be aware of any potential challenges or limitations that might come up after you’ve established a PREC. Some of the challenges you might face when you incorporate include the following:

- Limited activities allowed: As a PREC, your sole business activity should be focused on real estate services, such as helping people buy and sell homes or rent commercial space. A PREC can’t be involved in developing real estate, nor can it buy and sell stocks and bonds as a primary part of its business function. Additionally, a PREC can’t own real estate outside of what it needs to own to operate its primary business. For example, a PREC can own the office space it uses for its services, but it can’t own a shopping center that it leases to tenants.

- Costs of incorporating: In addition to the fees for incorporating, establishing a PREC can bring ongoing operating and administrative costs. For example, the PREC has to file its own tax returns and payroll, which might require hiring an administrative or tax professional. You might also need to hire legal counsel to help you set up the PREC.

- Liability limitations: Often, incorporation allows business owners to shift responsibility and liability from themselves as individuals to their corporations, providing a level of security and protection. However, that’s not the case with a PREC. The real estate agent remains liable for any services they provide under the PREC. You still need to uphold standards of ethics and responsibility and can face discipline if you violate them.

- Only one agent allowed: If you work with a team of real estate agents, each person would need to form their own personal corporation. You can’t establish a PREC for a group of agents.

Requirements of a PREC

A PREC can pay a real estate agent to provide real estate services as long as certain conditions are met. It can also pay shareholders, though specific conditions apply there, too. The requirements of a PREC include:

- A sole officer: Only the licensed real estate agent can be a president, voting shareholder or director of the PREC. They can’t split or share the role with others.

- Family members own non-voting shares: If others own shares in the PREC, they must be non-voting shares. Additionally, the individuals who own those shares must be related to the real estate agent, such as by marriage or birth.

- Separate licenses: You need to have your own real estate license if you establish a PREC. The PREC itself also needs a separate license.

- Employees of the PREC can’t have licenses: If the PREC employs others, such as an administrative assistant, the employees can’t have real estate licenses.

- Limited services: The PREC can only provide services having to do with real estate or directly associated with real estate.

- Rules: The PREC and the real estate agent must follow the rules of the Real Estate Services Regulations.

- Proper name: The business name of the PREC is not required to follow certain naming conventions, such as containing the phrase “Personal Real Estate Corporation”. This is completely optional.

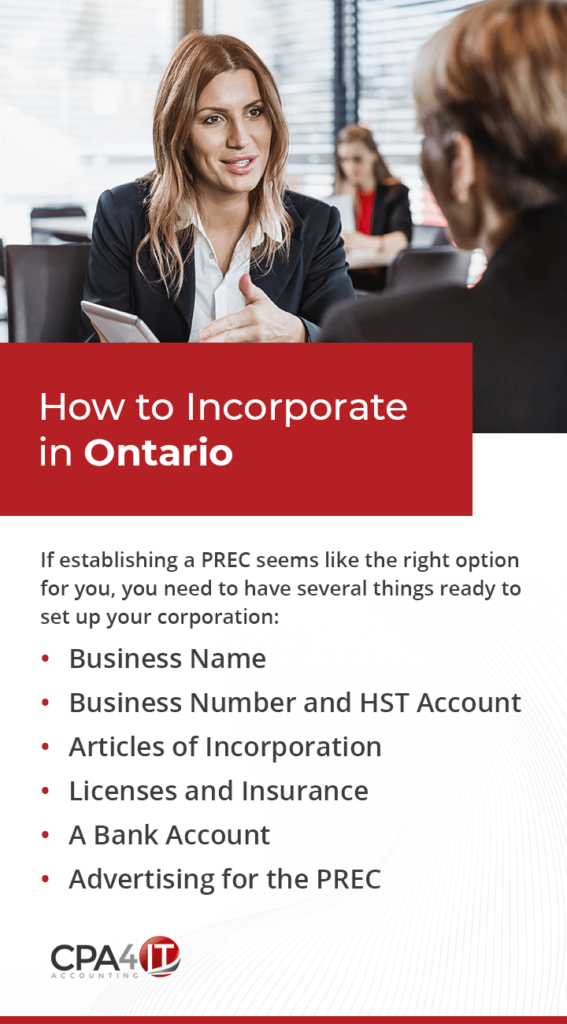

How to Incorporate in Ontario

If establishing a PREC seems like the right option for you, you need to have several things ready to set up your corporation:

Business Name

There are no limitations or specific requirements with respect to the name of a PREC other than those imposed on any Business Corporations Act. The name must meet the normal rules for corporate names and should not suggest that the PREC itself is trading in real estate.

If you choose to follow professional corporation naming conventions, the name can include Personal Real Estate Corporation. For example, if the agent’s name is Melissa Jones, the business name can be “Melissa Jones Personal Real Estate Corporation.” If the controlling individual previously used two names, such as a formal first name and a nickname, in business, they’d have to choose one or the other and wouldn’t be allowed to use the second name to advertise their PREC. If Melissa also goes by Mel but chooses “Melissa Jones” as the name connected to the PREC, she couldn’t also advertise as “Mel Jones Personal Real Estate Corporation.”

Business Number and HST Account

If you plan on establishing a PREC, you need to get a business number from the Canadian Revenue Agency. The business number of the PREC should be different from the business number you had as a sole proprietor.

You also need to create a new Harmonized Sales Tax (HST) account for the PREC if you anticipate sales being more than $30,000 in a 12-month period. Like the business number, the account you have as an individual agent doesn’t transfer over.

Articles of Incorporation

You’ll need to complete articles of incorporation to establish your PREC. The government reviews the articles and approves them. If you don’t file them and the government looks for them later, you will have to pay fees and penalties. Incorrectly incorporating can also lead to difficulties with correcting any issues in the future.

Working with a tax expert helps to ensure that you file the correct documentation when you incorporate your PREC.

Licenses and Insurance

A PREC needs to have a real estate license in Ontario, as does the real estate professional. You’ll need to apply for a license for the PREC after you’ve completed the incorporation process.

Additionally, you’ll need to get insurance coverage through a Workers’ Compensation Board since the PREC is a corporation and needs appropriate coverage.

A Bank Account

After you’ve incorporated the PREC and followed the licensing requirements, you’ll want to create a separate bank account for it. It’s a good idea to keep the business revenue the PREC earns separate from the salary or income the corporation pays you. When you open the account, bring a copy of your corporate records with you.

Advertising for the PREC

Once you’ve set up your PREC, you’ll need to shift your advertising to reflect it. That can mean ordering new business cards with the name and contact information of the PREC on them, as well as changing or setting up new social media profiles and a new website.

How Long Does It Take to Get Incorporated?

As long as you dot all of your I’s and cross all of your T’s, the process of incorporating a business in Canada doesn’t take very long. CPA4IT can help ensure that your business has everything that it needs to include when filing for incorporation. By investing a bit of your time upfront, you’ll reap the benefit of saving time and money in the long run. We can provide a more specific timeline for the incorporation process based on the service tier you choose and the unique needs of your business.

How Much Does It Cost to Incorporate in Canada?

For a limited period, we are offering FREE Incorporation services upon retaining one of our corporate tax packages. This means you can get your business up and running without worrying about any fees! Click here to learn more about this offer!

Talk With a Tax Expert at CPA4IT

Setting up a PREC can help you save money on taxes, sell your real estate business in the future or prepare you for retirement. However, setting up a PREC can be a complicated process because the rules for a PREC vary from province to province across Canada, so your best option is to work with a tax expert as you move through the process. CPA4IT works with real estate agents across Canada, providing business tax advice and incorporation services.

Book a free consultation with us today to learn more about establishing a PREC in Ontario or another province.