How To Make Incorporation Work For You

If you are self- employed, there are three forms of organization to choose from. We will show you why incorporation is the best choice!

1. SOLE PROPRIETORSHIP (Working for a placement agency)

As a sole proprietor, if you are earning more than $30,000, you are required to register for a business number and charge HST to your clients

Advantages

- Inexpensive to set up (Not required to register a company name)

- Eligible to deduct expenses

- Income split with spouse

Disadvantages

- Unlimited liability

- Income is subject to the personal tax rate

- All income must be distributed - can not leave money in the business

- Must have Dec 31 year-end

2. PARTNERSHIP

In a partnership, if you are earning more than $30000, you are required to register for a business number and charge HST to your clients

Advantages

- Inexpensive to set up – must register business name with a partner

- Eligible to deduct expenses

- Income split with spouse

- No EI premiums

Disadvantages

- Unlimited liability

- Either partner can bind the other

- Income is subject to the personal tax rate

- All income must be distributed - can not leave money in the business

- Must have Dec 31 year-end

3. CORPORATION

Advantages

- Leave money in the corporation and pay only 12.20% on first $500k of taxable income

- Limited liability

- No EI premiums

- Income splitting before and after tax

- Long term savings plan

Disadvantages

- More costly to set up and maintain

How is $150,000 of Contract Income Taxed?

Scenario

Joe Consultant has been offered a contract position with an income of $150,000 per year. Which form of organization would save him the most money? Joe is married and his spouse does not work outside the home.

*Sole Proprietorship and Partnerships have been included together because your income will be taxed personally neither option

PAYROLL TAXES

Payroll taxes are CPP (Canada Pension Plan) and EI (Employment Insurance).

In addition to paying more personal tax than incorporated entities, sole proprietors working through an agency, are required to pay EI premiums. Every individual working in Canada is required to pay CPP. EI and income tax are based on your personal income.

CPP – 5.95 % to a maximum contribution of $3,754.45 (2023)

EI – 1.63% to a maximum contribution of $1002.45 (2023)

* Calculations are based on scenario with Joe Consultant

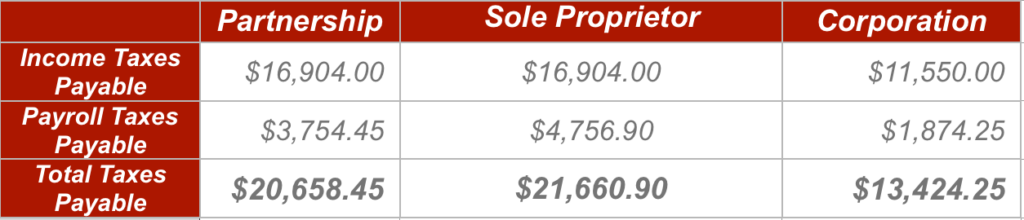

Once you have paid your personal and corporate taxes you are also required to pay payroll taxes as well. Below you will find a breakdown of the total taxes for each form of organization.

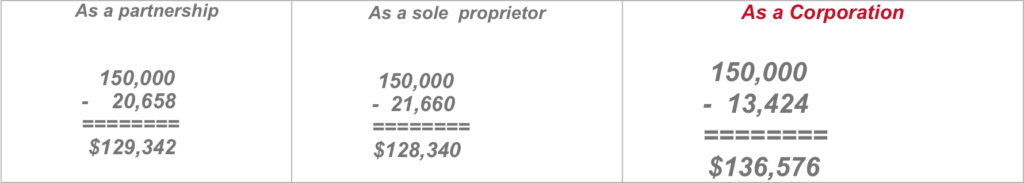

Which form of organization will leave Joe Consultant with the most money in his pocket?

It is clear that when you choose a corporation, you pay significantly less tax and have more money in your pocket than if you chose sole proprietorship or a partnership.

Now that Joe Consultant has money left in his corporation – how does he access it?

STRATEGIES TO ACCESS MONEY LEFT IN CORPORATION

1) Dividends

The money that is left in your corporation has already been subjected to the corporate tax rate of 12.20%. To avoid double taxation, dividends that have already been taxed corporately are taxed differently in the hands of the shareholders that receive them.

Dividends are taxed more favorably that regular income. In effect, if you have no other income you can receive up $31,000 of dividend income – tax-free!

This strategy can enable you to keep income you have already paid tax on, inside the corporation and to take out these amounts when you will have no other income. For example:

- During your retirement, you could access up to $31,000 each year without paying any further tax – effectively using your corporation as a long-term savings plan

- You could split income with individuals who may not be earning an income i.e., retired parents or in-laws

2) Borrowing from the Corporation

It is possible to borrow income from your own corporation on which you have already paid tax. You pay the prescribed Canada Revenue Agency interest rate, which can be very tax effective.

You can borrow money from your corporation for the purpose of purchasing a car or a house. This money must be paid back to your corporation with interest over a period. The term of the loans cannot be longer than the term you would be able to arrange with a bank or a car financing company.

3) Investments

Making investments in the name of your corporation is an effective method of utilizing your earnings to achieve a profit.

CAVEAT

The advantages and disadvantages mentioned do not cover the entire spectrum of issues related to incorporating. Some of them can be quite complicated and should be discussed with professional advisors.