If you have made the decisions to venture into the world of entrepreneurship, it is important to start by identifying if you should set up a Sole Proprietorship or set up a Corporation.

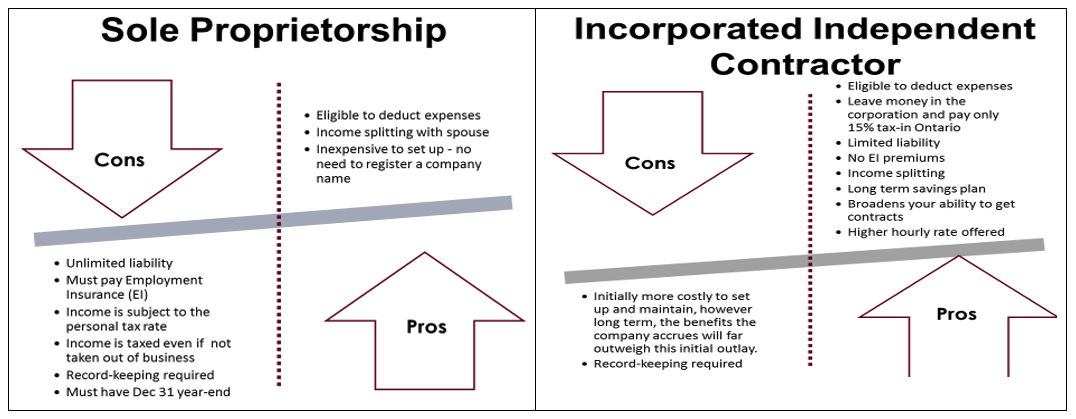

These are some of the Pros and Cons between being a Sole Proprietor vs. Incorporated Independent Contractor:

Many large staffing agencies prefer to deal only with incorporated contractors rather than sole proprietor contractors. Hence operating as an incorporated entity can dramatically increase your marketability.

You can significantly reduce your overall income taxes by leaving income in your corporation that will only be taxed at approximately 20% and avoid the highest personal income tax rates of 40% to 50%. Using the low corporate income tax rate, you can retain income in your company, and use your company as a strategy to accumulate a significant retirement investment portfolio for yourself.

Should your contracting or consulting income fluctuate significantly from one year to the next, you can use your company to smooth out your personal income over two or more years, resulting in lower overall income taxes.

We have developed a Sole Proprietor vs. Corporation calculator tool, which has been designed to let you determine the potential tax savings you could achieve by Incorporating. It compares two contract opportunities, one Sole Proprietorship Entity and one on contract operated through an Incorporated Entity. You can use this calculator to learn the estimated tax savings of choosing one form of organization over the other.

Sole Proprietor vs. Corporation calculator

We have also compiled a Corporation Guide that details all the tips and tricks of incorporating a new company, and how to get started. The steps outline how you can set yourself up for the best tax situation possible, what mistakes to avoid.

There is risk associated to being classified as Personal Services Businesses by CRA. Understanding and protecting yourself the risks of this CRA designation is extremely important for professionals and independent contractors. Fortunately for our clients, at CPA4IT we have the knowledge and expertise to ensure that your business is taxed as a small business and not a PSB. If you are worried that you may be classified as a Personal Service Business, please take our PSB Classifier Survey.